DebtBusters' Money-Stress Tracker 2024: Financial concern slightly lower, but women hit harder

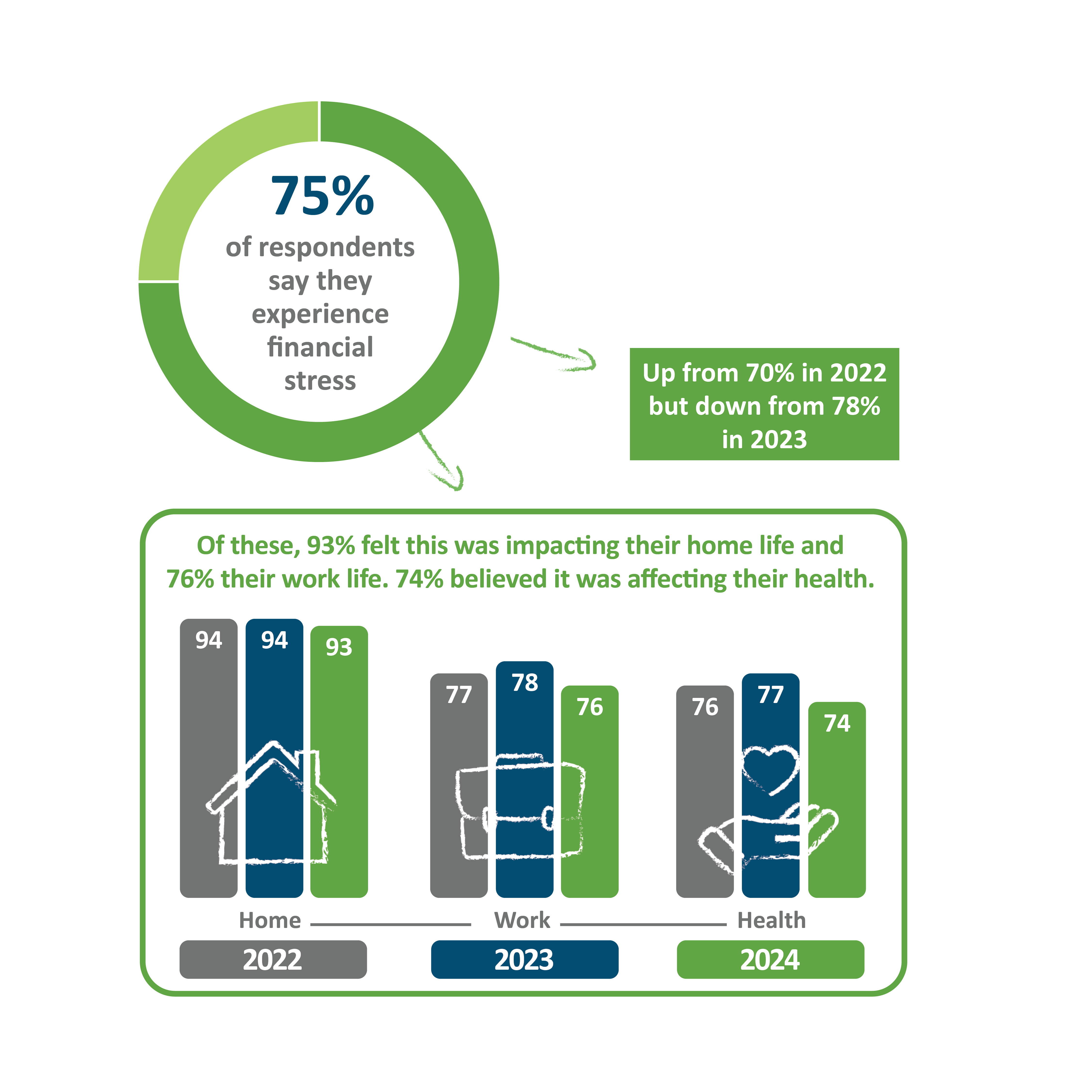

With the past year bringing slight relief from load shedding, and interest rates remaining stable, some 3% fewer respondents in this year’s Money-Stress Tracker said they are experiencing financial stress, compared with 2023. However, the figure remains elevated at 75% – an increase on the inaugural figure reported in 2022 – this being 70%.

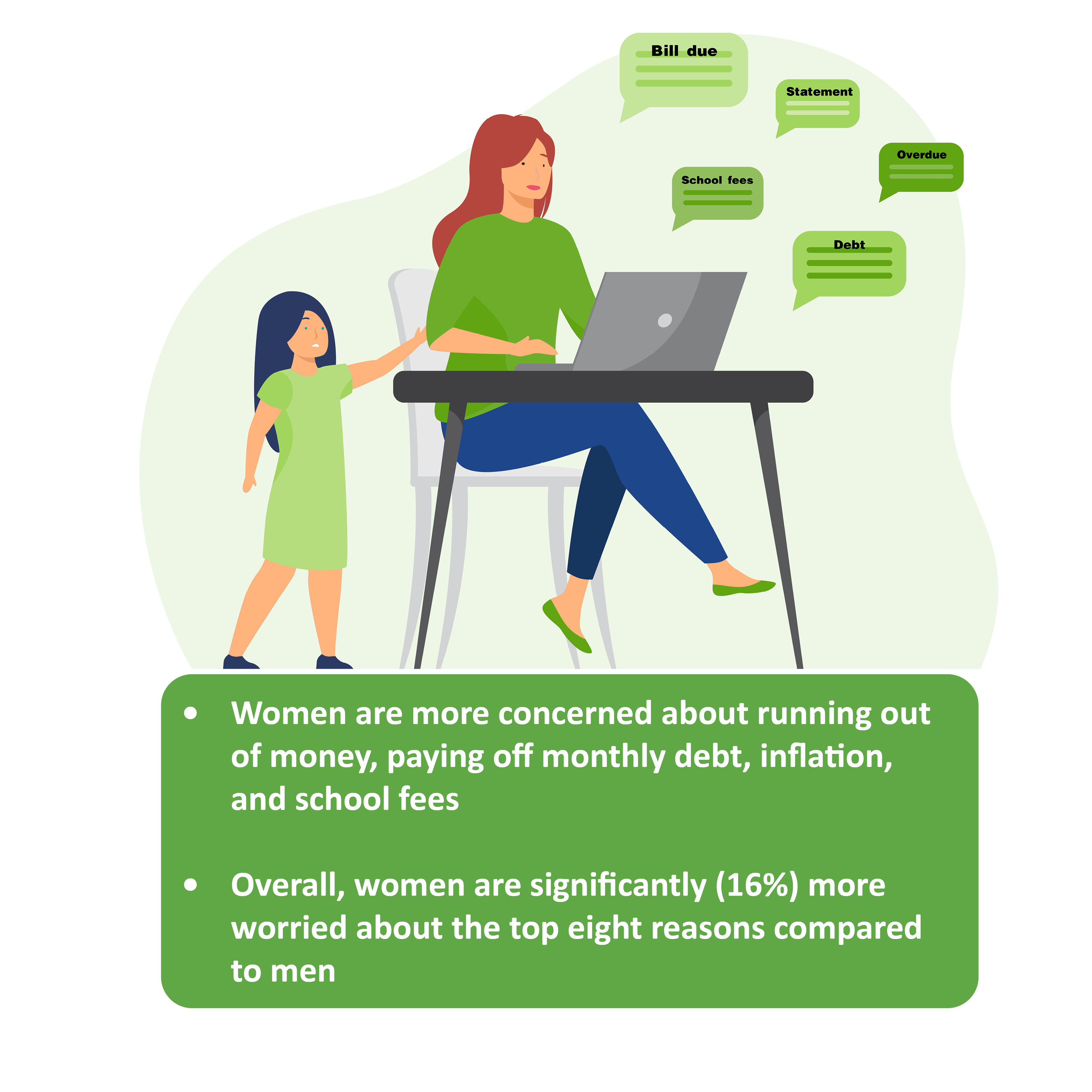

As with previous years, female respondents are more financially stressed than men, with almost four out of five female respondents saying they suffer from financial stress.

What is the Money-Stress Tracker?

The Money-Stress Tracker polls subscribers of the DebtBusters website and platform, tracking the impact of financial stress on their home life, work life, and health.

With over 26,000 responses this year, this is one of the most extensive surveys conducted in South Africa, to assess how financial stress impacts other aspects of life.

The results

Three out of four South Africans feel money-stressed, particularly women, who admit to feeling the effects of financial stress at home and work.

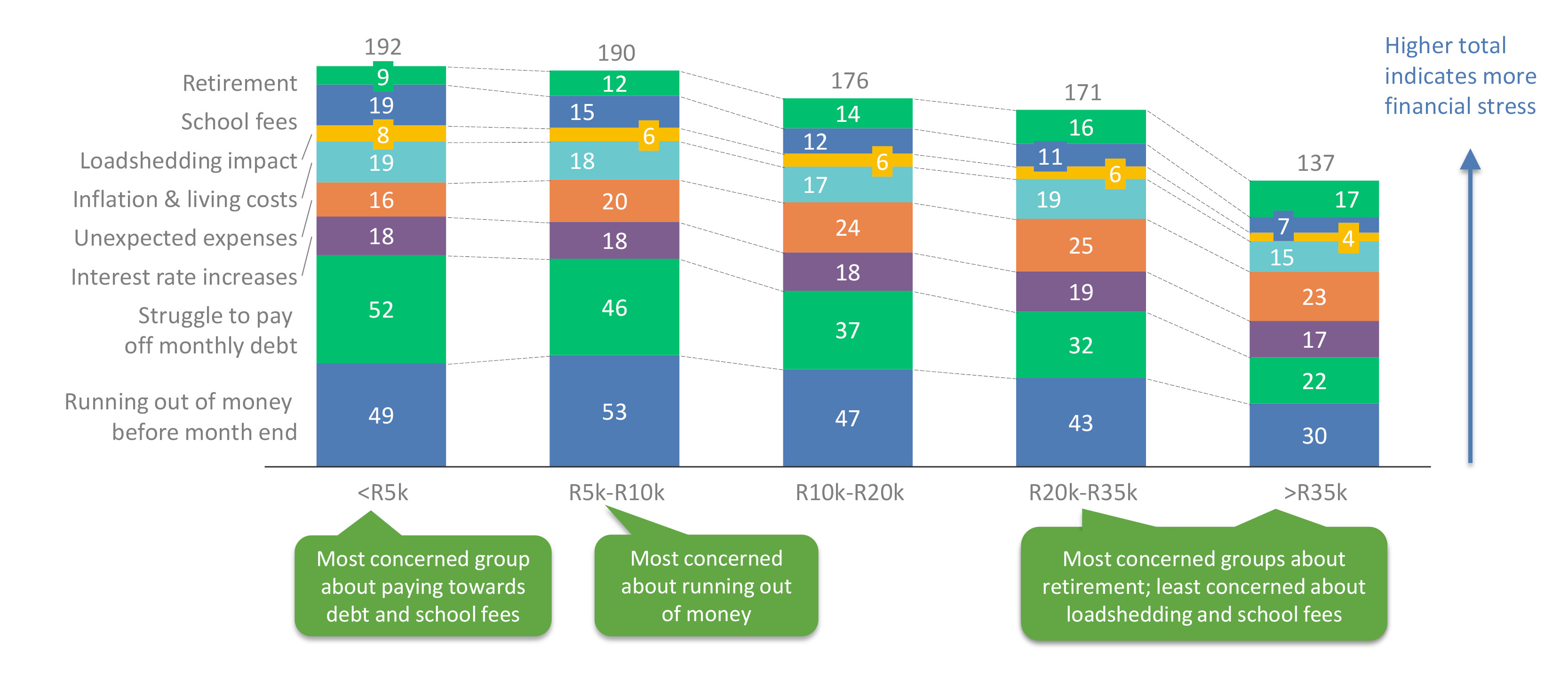

Lower-income earners are most stressed about paying their debt and school fees, while those on the upper end of the earning scale are most concerned about retirement.

Women are 16% more stressed than men across the top eight financial stressors; a significant difference.

Money-Stress Tracker survey key insights:

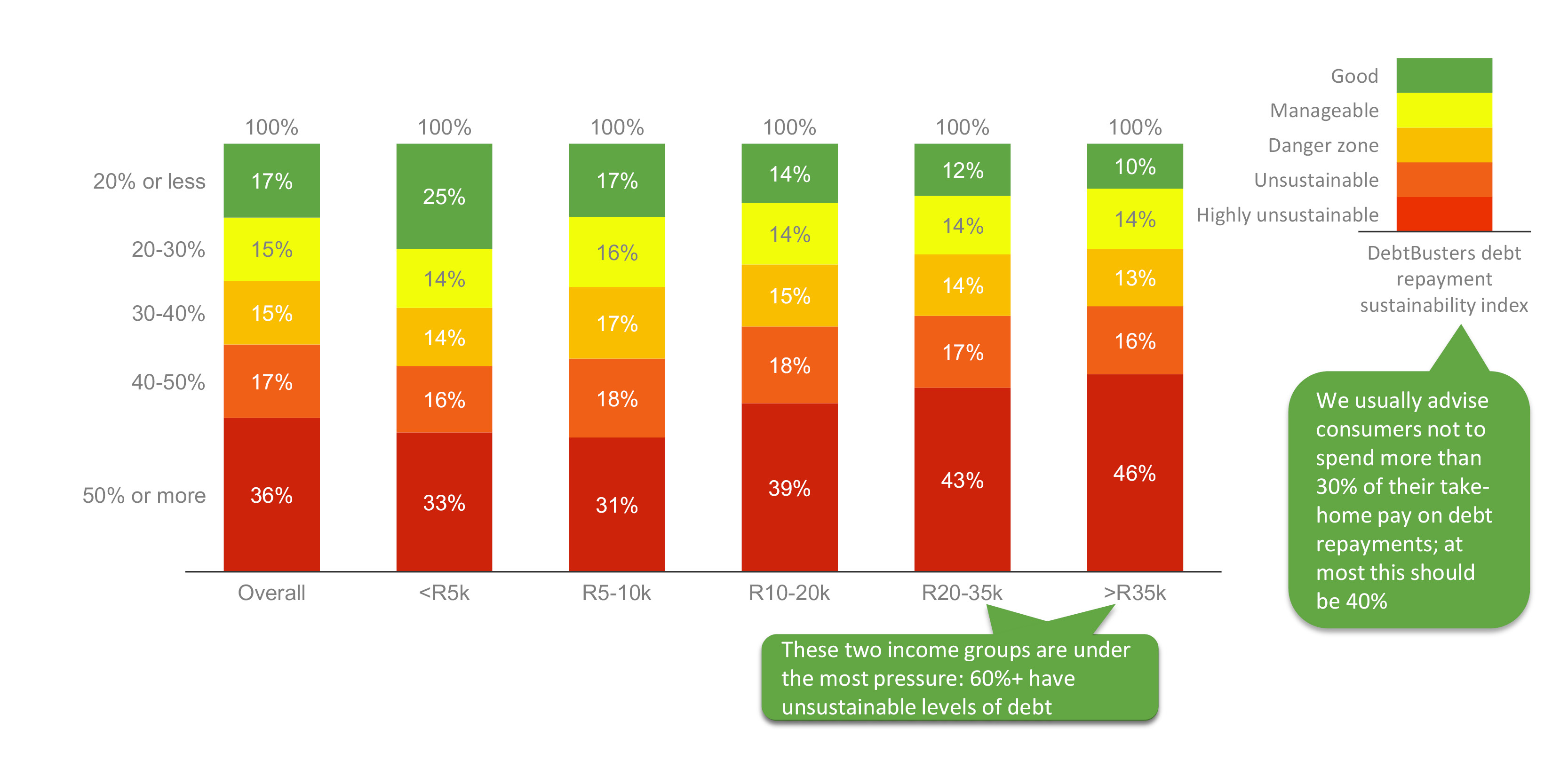

1. Some 43% of middle-income earners have highly unsustainable debt levels

Some 43% of the respondents in the R20-35k income bracket have highly unsustainable levels of debt. This income band is the backbone of South Africa’s middle-class population.

Need debt counselling or consolidation?

Explore DebtBusters' solutions for reducing your interest rates and unlocking cash.

Find out more

2. Almost four out of five women suffer financial stress

Almost four out of five (roughly 80%) of women indicated that they suffer from financial stress, compared with three out of four (75%) of respondents overall.

Women are most concerned about running out of money, paying off monthly debt, inflation, and unexpected expenses.

3. Inaction and a lack of trust inhibits positive action

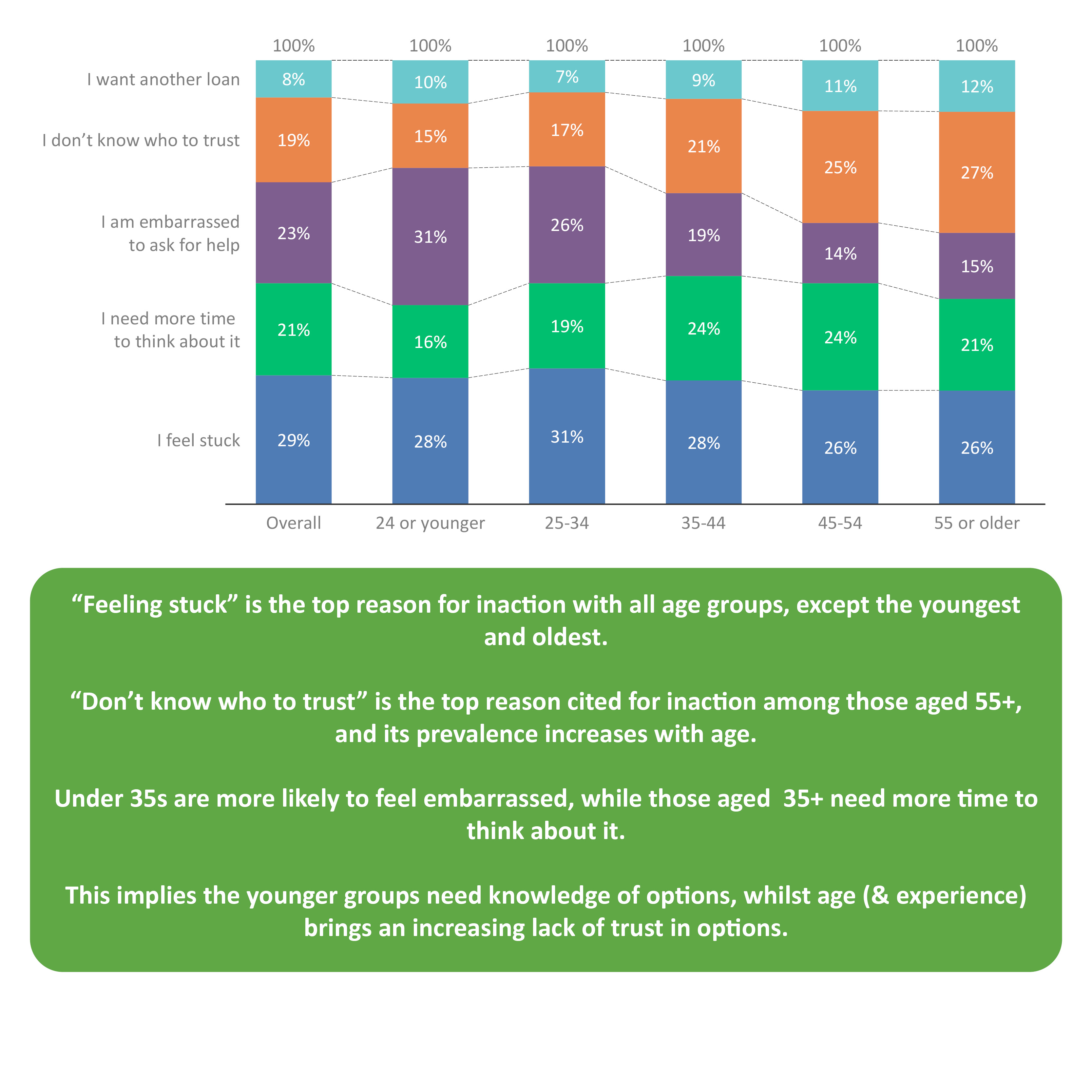

“Feeling stuck” is the top reason for inaction, at 29%. “I don’t know who to trust” is the top reason cited for inaction among those aged 55+, while under 35s are more likely to feel “embarrassed to ask for help”.

This implies that the younger groups need information about possible solutions, while age and experience seem to increase the lack of trust in options.

To deal with money stress, all age groups said they were cutting back on spending, a strategy that, on average, 38% of respondents have adopted, down from 44% in 2023. The findings also show that, on average, 31% are seeking a better job or higher pay.

Conclusion

While there is help, people are either too wary to seek it out, or are unaware of it. DebtBusters' goal is to reach as many people as possible, and show that there is a path to debt freedom. Read the full Money-Stress Tracker 2024 press release here.

Download the detailed results of the 2024 Money-Stress Tracker here.